How To Accept Payments for NIL Deals

What you need to know about getting paid for your work

You’ve worked hard to become a successful NCAA student-athlete. Now NIL lets you profit from that hard work.

You’re likely hearing all kinds of advice about handling your business. Once you decide to accept a deal, the most important thing is getting paid what you were promised.

Here’s what you need to consider when accepting payments for NIL deals.

Have a contract

Now that you’ve agreed to take a NIL deal, the most important thing to do is execute a proper contract.

Contracts spell out exactly what you will and won’t do, what you are getting paid for, and when/how much you’re paid.

It might seem like an extra hassle and unnecessary step, but it gives you a way to fight back if you hold up your end of the deal and then don’t get paid.

Whether you are creating the contract yourself or one is being presented to you, there are certain elements you want to be sure are included:

The exact description of work you will and won’t do.

Exactly what payment you will receive. This includes cash and non-cash items such as merchandise, tickets, gift cards, travel, etc.

When you will receive the money. Do you require a deposit to be paid up-front? If so, will you allow refunds for any reason? When will the balance of the money be paid?

How you will be paid. Will a payment app be used? Will you accept cash or check? If so, getting a receipt is crucial to prove the payment was received and for your record-keeping.

Consider using a NIL platform

You can make NIL deals on your own, from finding them all the way to contract and payment. But there is a lot for you to consider and keep up with throughout the process.

One way to make the process easier and more certain that the deals you make are reputable, in compliance, and that you will get paid, is by using a NIL platform.

Companies like Dreamfield, Opendorse, and Icon Source operate platforms where athletes can connect with businesses looking to make NIL deals.

These platforms have staff to help verify deals are compliant, offer standard contracts, and some even provide escrow to help ensure you get your money when the deal is done.

This allows you to spend more time finding deals, responding to ones that are offered to you, and perfecting your brand and social media presence to attract even more deals.

Be flexible with payment options

If you use a NIL platform, it will distribute payment for NIL deals you fulfill.

But should you choose to do it on your own, it will be essential to consider the payment platforms you want to use and be flexible with your clients.

You will need to study the pros and cons of each payment app. Do you want to connect your bank account? Do you want people to be able to pay you with credit cards?

Each app is slightly different, with pros and cons to the various fees, security, and speed.

The more research you do, the fewer surprises you’ll find when it comes time to get paid—especially if there are difficulties collecting.

For instance, Venmo is one of the most popular payment apps. But its heavily used “Friends and Family Payment” option, which keeps you from being charged a fee, leaves you with limited recourse should a problem arise.

Consider it with caution.

Keep good records

The NCAA and your school require that you disclose the details of every NIL deal you take part in. Keeping good records is essential for reporting and staying compliant.

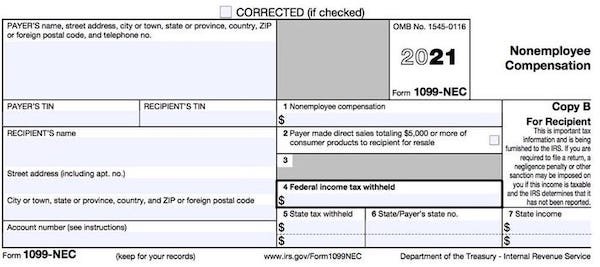

Good records will benefit you in other ways too. You will be required to pay taxes on the money you earn, and you must have records to report those earnings accurately.

Those records must include who paid you, what you made, and how they paid you. Businesses will also issue 1099 forms, which you must keep and file with your taxes.

At tax time, see a professional, and you will confidently have anything they might need to complete your tax return.

Setting aside some of your NIL earnings to pay taxes is vital. Too many athletes don’t do this, leaving them with an unexpected tax bill.

Dreamfield has an excellent article about managing your NIL money, which covers this and many other subjects. You can find it here.

It sounds complicated, but it can be as simple as using a spreadsheet. There are also free online accounting platforms like Wave Apps that make the process easier.

To recap

Make sure you complete a contract for every NIL deal you do. It should specify what work will be done, what you will be paid, how and when you will be paid

Joining a NIL marketplace platform can make things easier and more secure for you, leaving you with more time to find deals

Consider various payment options and applications, each has pros and cons, being flexible with what you can take will increase your ability to make deals

Always keep good records for compliance reporting and tax purposes. Save money from your earnings to pay taxes.